Last updated: January 07 2026

Downsizing Your CRA Tax Files?

Evelyn Jacks

Happy New Year! If one of your resolutions for 2026 is to downsize, or at least sort through all that stuff you don’t need anymore, you may inevitably run across those tax files you’ve been keeping for decades. Just how long do you have to keep them? Do you need permission to destroy them? From whom? Read on to learn more.

Backdrop – The Destruction of Tax Records. Tax records (and yes, that includes electronic records) must be kept for a minimum of six years from the end of the last tax year to which they relate. That means different things; depending upon who the taxpayer is. For example, the tax year is the calendar year for individuals, the fiscal period for corporations and for trusts, the tax year can vary, depending on the type of trust in question.

Therefore, if an individual files a return for the 2025 tax year, those records must be kept for six years to the end of 2031. If the 2025 tax year is reassessed in 2027, keep the records until the end of 2033.

There are exceptions to these general rules, however. For example:

- Late Filed Returns. If you file an income tax return late, you must keep your records for six years from the date you file that return.

- Property Owners. Historical information about taxable assets must be kept longer. Records and supporting documents that support the cost and improvements of asset acquisitions and/or the disposal of any property including financial assets, and real estate including principal residence dispositions.

- Business Owners. Be sure to keep share registries, or other information that will have an effect on the sale, liquidation or wind‑up of the business, you have to keep them indefinitely.

- Business Wind-ups. There are different rules to observe:

- Non-incorporated business - keep records for six years from the end of the tax year in which the business ended.

- When a corporation is dissolved - it must keep all records for two years after the date of its dissolution.

- When corporations amalgamate or merge - New Co must keep the business records of each of the amalgamated or merged corporations for six years from the end of the taxation year to which they relate.

- CRA-Requested Storage. If the CRA wants you to keep records for a period longer than six years, a CRA official will let you know how long to keep them either in person or by registered mail.

- Death of a Taxpayer – legal representatives can destroy records after receiving a clearance certificate(s) to distribute property

Records Must be Kept in Canada. Tax records must be kept at your place of business or your place of residence in Canada. It’s interesting to note CRA’s directive on electronic records: they do not consider records kept outside of Canada but accessed from within Canada to meet their requirements. In fact, if you want to keep them elsewhere, you must request written permission first, and if that’s granted CRA may impose certain conditions for recordkeeping. You must also make records available in Canada upon request by the CRA for their review.

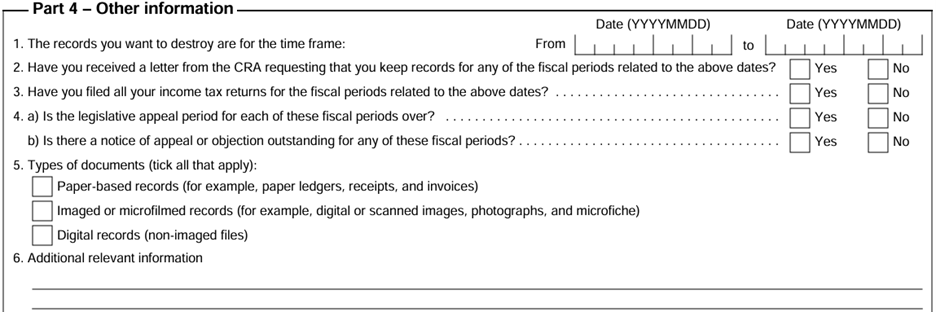

Form T137 Request for Destruction of Records. Requesting permission to move or destroy your records requires this special form. Pay special attention to Part 4 and be sure these questions can be answered:

Pro Tax Tip: Before granting a request for permission to destroy records, CRA will require that all tax returns for the period in question must be filed and there cannot be any outstanding appeals.

Always Prepare an audit-proof return. The detailed documentation required to prepare tax returns in the most effective manner and then store documentation to back up the claims in a manner to weather through future tax audits is the two part role of basic tax preparation. This is a minimum requirement of ongoing professional services. The real win, however, comes when tax, wealth and estate planning is added to the relationship.

Provide peace of mind by ensuring your clients can call you for their tax documentation, properly filed, so that if they have misplaced it or can’t find it in their electronic world (a common occurrence), they know you have it covered!